Trading & Risk

PolyPaths offers a versatile and easy-to-use software platform for fixed income portfolio analysis and risk management that meets a diverse set of needs for bond and derivative traders, risk managers, and portfolio managers.

Analysis includes scenario shocks, relative value analysis, pricing, hedging, risk management and returns attribution. PolyPaths Trading & Risk Management solutions are designed to perform risk analytics on a wide variety of fixed income instruments and can scale from small hedge funds to major banks and broker/dealers.

PolyPaths Trading & Risk Management combines tremendous flexibility with comprehensive analytic rigor and includes:

COMPREHENSIVE INSTRUMENT COVERAGE

It covers a wide variety of fixed income securities, loans, and derivatives, including, but not limited to, MBS, ARM, CMO, ABS, CMBS, Treasury, corporates, munis, structured notes, agency debt, options, currency options, futures, swaps, cross currency swaps and foreign currency denominated securities. In addition, users can load and value mortgage servicing rights and whole loan portfolios.

COMPREHENSIVE RISK AND RETURN ANALYTICS

It employs leading-edge interest rate models for pricing and risk analytics. The wide array of risk and return measures are used daily by active market participants for trading and hedging decisions. The solution can also perform credit analysis with user assumptions or third‐party credit models. In addition, PolyPaths offers historical return and return attribution analytics for buy-side applications.

SPEED & SCALABILITY

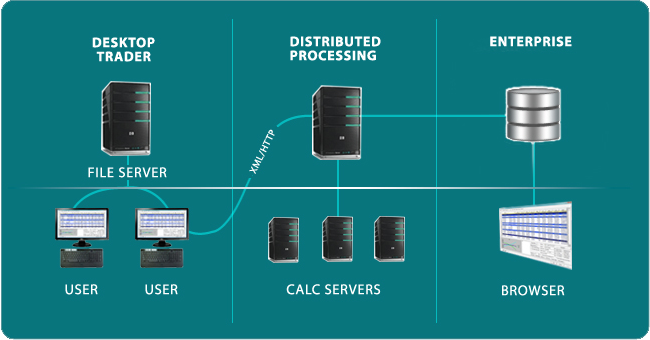

PolyPaths’ Distributed Processing system is designed to handle large scale calculation jobs. The robust parallel processing architecture can support grids with hundreds of processors and comes with a web‐based management console that continuously monitors the status of the entire grid greatly reducing administrative overhead. PolyPaths’ analytics engine also utilizes all the cores in a multi‐core PC to speed up portfolio calculations.

EASE OF USE

The solution offers an intuitive and flexible interactive user interface. Portfolios can be easily constructed, pricing assumptions can be easily entered and reports easily viewed. A batch utility also automates routine risk reporting jobs and simplifies maintenance.

EASE OF INTEGRATION

PolyPaths easily integrates the many user‐supplied models and data found in most trading environments. In addition, outputs from the system can be easily exported and fed into other systems. There are also programming interfaces available to tightly integrate PolyPaths analytics into customers’ in‐house systems.